The benchmark for financial contentment shifts as economic tides evolve. While $75,000 was once considered a gateway to satisfaction, recent findings suggest earnings of up to $500,000 correlate with heightened well-being.

The Changing Definition of Success

Historically, $75,000 was considered the apex of financial fulfillment; however, contemporary research challenges this notion, indicating higher earnings – up to half a million dollars – contribute positively to overall happiness.

Beyond $75,000: A New Perspective

Contrary to the previous $75,000 benchmark, current data suggests this figure may no longer equate to true financial contentment. Adjusting for inflation, a revised target of $122,000 annually is now the updated threshold for financial well-being.

Striving for Affluence

Anyone aiming to join the top tier of American wealth often faces substantial hurdles. According to IRS data, earning an adjusted gross income (AGI) of at least $540,009 qualifies one for the esteemed top 1% of earners. This benchmark sets the bar remarkably high.

The Six-Figure Milestone

Earning a six-figure income carries a symbolic significance linked to financial stability and security. However, the allure extends beyond mere numerical appeal – it reflects the ever-growing need for additional resources to mitigate potential uncertainties.

The Path to Financial Contentment

David Frederick, a financial planning expert, underscores the role of a financial plan in attaining genuine happiness and security. “Such a comprehensive strategy empowers individuals to identify and address potential financial risks, thus fostering a sense of preparedness,” he says.

The Essence of a Solid Financial Plan

Every individual has different goals and risks, so a tailored financial plan helps make smart money choices. It’s a map that guides you through personal finance complexity. Whether earning $50,000 or $500,000 annually, having a strategy for your situation is beneficial.

Preparing for the Unexpected

A key aim of financial planning is building resilience against unpredictable challenges. Emergency funds, insurance coverage, and diverse investments can cushion the blow of unanticipated events.

Investing in Education and Retirement

Saving for education costs and retirement funds are vital parts of a comprehensive financial plan. Allocating money to these ensures long-term financial stability and peace of mind.

Maintaining Homes: Addressing Costs and Upkeep

Owning a home brings a mostly unexpected set of financial commitments. The need to plan for mortgage payments, property taxes, and repair funds becomes stronger than ever. Setting money aside preserves the property’s condition and worth.

Finding Balance: Present Joys, Future Goals

Even though financial planning encourages foresight and prudence, it’s vital to balance the present joys with future goals. Budgeting for fun activities, trips, and entertainment allows people to appreciate life while still meeting long-term financial aspirations.

Empowering Financial Knowledge

A key part of financial planning is promoting financial literacy and empowerment. Learning about budgets, investments, and debt management helps people take control of their financial futures and make informed choices.

Overcome Psychological Obstacles

Inner roadblocks, like fear of going broke or hesitance to seek expert guidance, may block the path to smart money management. Spotting and tackling these inner obstacles paves the way for a positive, proactive personal finance approach.

Utilize Digital Tools for Financial Management

In our modern world, technology smooths the journey of managing finances. From budgeting apps to investment platforms, leveraging tech tools simplifies processes, giving you clearer, easier control over finances.

Adopt an Open, Growth-Focused Mindset

Willingness to learn new things, adjust, and persevere is key for navigating ever-changing money landscapes. Embracing a growth mindset equips you to overcome hurdles and seize chances for building financial strength and prosperity.

Develop Financial Discipline

Adhering to financial plans and goals is crucial for long-term success. This involves following budgets diligently, maintaining investment strategies, and avoiding impulse purchases. Developing strong financial discipline lays the foundation for achieving your aspirations.

Seek Professional Guidance

While managing finances independently is commendable, seeking advice from financial experts can provide invaluable insights and tailored strategies. Professionals in this field offer personalized recommendations to optimize your financial plans and maximize your returns.

Investing in Personal Growth: A Holistic Approach

Personal development revolves around more than just the financial aspects; it involves nurturing career advancement, enhancing skills, and promoting overall well-being. Investing in self-improvement fosters a balanced life and increases your capacity to thrive in all areas.

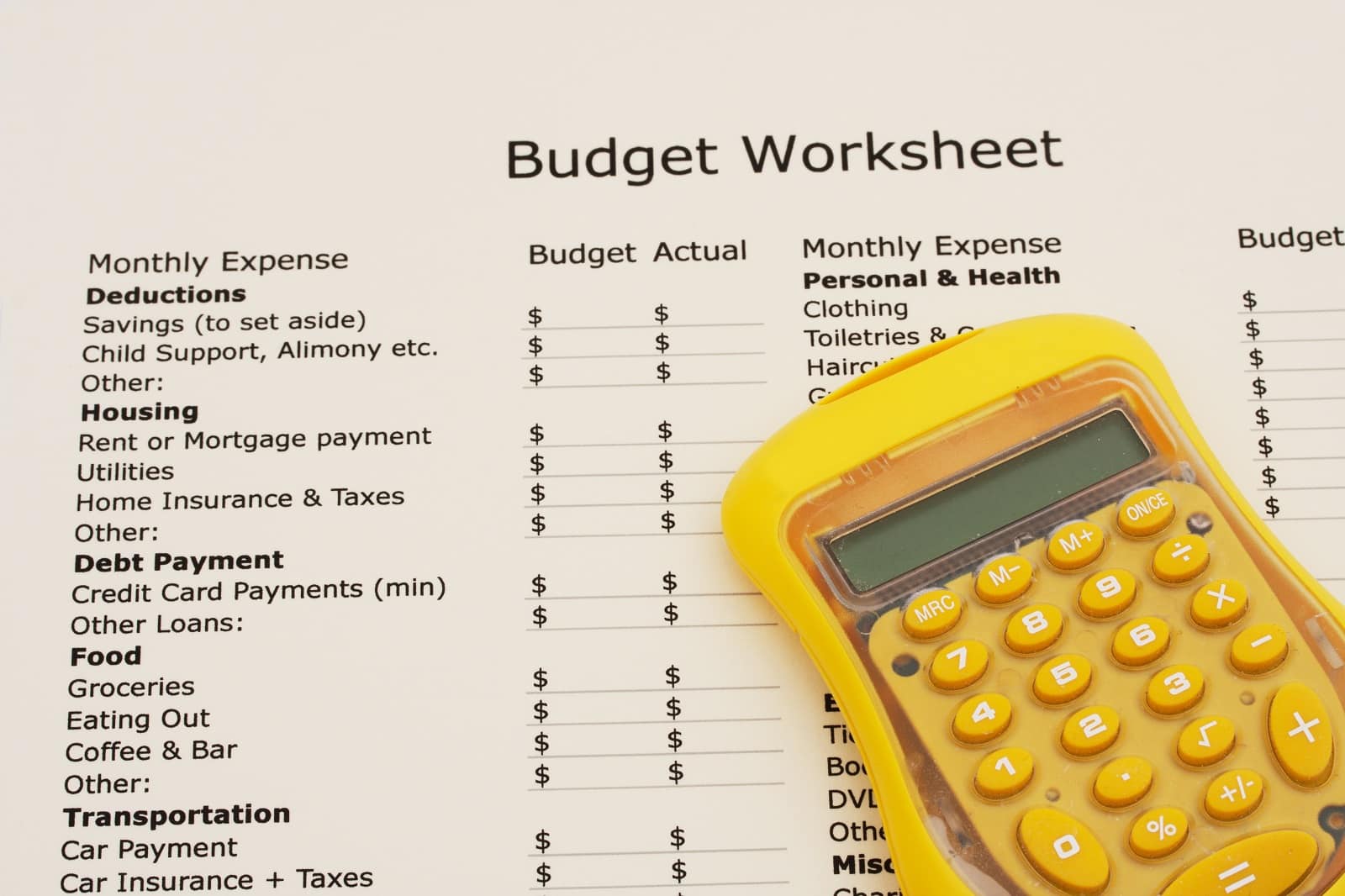

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

The Path to Self-Discovery: 15 Steps to Finding Your True Self

Embarking on a journey of self-discovery goes beyond mere introspection; it requires actionable steps backed by research to uncover your authentic self. Here are 15 evidence-based strategies and practical steps to get started on each. The Path to Self-Discovery: 15 Steps to Finding Your True Self

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Grow Every Day: 14 Habits for Tangible Personal Progress

Ready to take your personal growth journey to the next level? Incorporating small, tangible practices into your daily routine can lead to significant positive changes in your life. From expressing gratitude to nurturing connections with loved ones, these 14 daily habits are designed to empower you to thrive and flourish. Let’s dive in and elevate your life one day at a time! Grow Every Day: 14 Habits for Tangible Personal Progress

The post The New Benchmark: $500,000 Is the Ticket to Financial Success Today first appeared on Not Your Boss Babe.

Featured Image Credit: Shutterstock / Gorodenkoff.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply