Are you constantly shocked by your property tax bill, or are you considering moving to another state and trying to gauge the fiscal landscape? What might your tax bill look like in these states in 2024?

1. New Jersey

New Jersey holds the dubious honor of the highest property taxes in the U.S., with the average homeowner paying around 2.49% of their home value annually, translating to several thousands in taxes each year.

2. Illinois

Plagued by financial challenges, Illinois sees an average property tax rate of 2.27%. This rate can result in significant annual expenses, especially in affluent areas around Chicago.

3. New Hampshire

Known for no state income tax, New Hampshire makes up for it with property taxes. The average rate hovers around 2.18%, leading to high out-of-pocket costs for property owners.

4. Connecticut

With some of the highest property values in the country, Connecticut’s property taxes average about 2.14%. This combo hits homeowners hard in their bank accounts.

5. Wisconsin

Wisconsin’s average property tax rate is around 1.76%. This might not seem as high, but paired with home values, it can still put a dent in your finances.

6. Texas

Texas might offer no state income tax, but its average property tax rate of 1.80% compensates for that, significantly impacting homeowner expenses, especially in urban areas like Austin and Dallas.

7. Nebraska

Homeowners in Nebraska face an average property tax rate of 1.73%, which places it among the top states for property tax expenses, a tough pill for many in the Cornhusker State.

8. Vermont

Despite its small size, Vermont has an average property tax rate of 1.90%, which, combined with rural infrastructure costs, can escalate living expenses unexpectedly.

9. Michigan

In Michigan, the average property tax rate stands at 1.54%. This rate can lead to particularly high bills in areas with higher home values.

10. Rhode Island

Rhode Island may be tiny, but its property tax rate of about 1.63% packs a punch, especially given the high property values in certain coastal areas.

11. Ohio

With an average property tax rate of 1.56%, Ohio sees a wide variance in what homeowners end up paying, with some counties approaching rates much higher than the state average.

12. Pennsylvania

Property taxes in Pennsylvania average about 1.50%. In urban centers like Philadelphia, these rates combined with high property values can be quite burdensome.

13. New York

New York’s average rate of 1.72% is steep, but in areas around New York City, rates can soar much higher, driving up living costs dramatically.

14. Iowa

Iowa’s property tax rate averages at about 1.53%. This rate is felt particularly in larger urban areas like Des Moines, where city services push tax bills higher.

15. Massachusetts

Massachusetts homeowners face an average property tax rate of 1.23%. High home values in the Boston area mean these taxes can quickly add up to a large annual expense.

16. Kansas

Kansas has an average property tax rate of 1.41%. In populous counties, higher valuations mean that residents often face steep tax bills.

17. Minnesota

In Minnesota, the average property tax rate of 1.12% is moderate but can feel higher due to the state’s relatively high property values and additional local levies.

18. Washington State

Washington State’s average property tax rate of about 1.01% might seem lower, but in high-demand areas like Seattle, property values push actual tax payments quite high.

Take a Deep Breath

While these rates might give you sticker shock, understanding the average property tax rates can help you budget better or choose wisely where to buy your next home. Knowledge is power—and in this case, it might also mean savings!

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

The Path to Self-Discovery: 15 Steps to Finding Your True Self

Embarking on a journey of self-discovery goes beyond mere introspection; it requires actionable steps backed by research to uncover your authentic self. Here are 15 evidence-based strategies and practical steps to get started on each. The Path to Self-Discovery: 15 Steps to Finding Your True Self

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Grow Every Day: 14 Habits for Tangible Personal Progress

Ready to take your personal growth journey to the next level? Incorporating small, tangible practices into your daily routine can lead to significant positive changes in your life. From expressing gratitude to nurturing connections with loved ones, these 14 daily habits are designed to empower you to thrive and flourish. Let’s dive in and elevate your life one day at a time! Grow Every Day: 14 Habits for Tangible Personal Progress

The post Property Tax Nightmares: 18 States With the Worst Rates first appeared on Not Your Boss Babe.

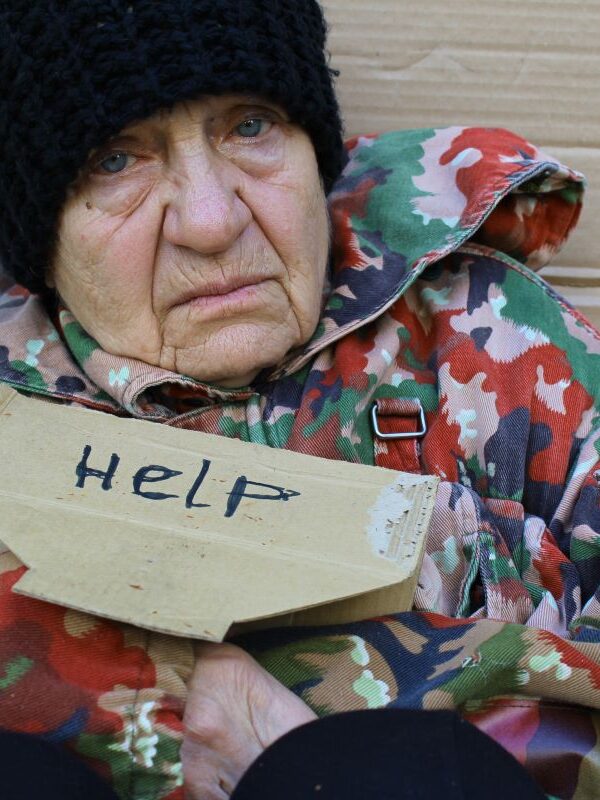

Featured Image Credit: Shutterstock / Krakenimages.com.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply