The belts are tightening in American households, and the ripple effects are reaching big retail players. Home Depot recently reported a 3.6% dip in comparable store sales, signaling a cautious consumer approach as economic pressures mount. As homeowners prioritize budgets, spending on home improvements is taking a hit.

Tightening Belts: Homeowners Cut Costs

American homeowners are cutting back on home improvement spending overall. Home Depot reported a slight increase in net sales to $43.2 billion, yet comparable sales in the U.S. dropped by 3.6%, showcasing a shift in consumer spending habits.

Economic Pressures Mount

Home Depot CEO Ted Decker attributed the decline to high interest rates and economic challenges, both of which reduced consumer demand for home improvement. “A more cautious sales outlook is warranted for the year,” Decker explained.

Sales Dip at America’s Renovation Giants

Despite a minor uptick in total sales, problems remain for the retailer. Sales might drop between 3% and 4%, with a gross margin projection dropping to 33.5%.

Economists Chime In

Analysts such as Seth Basham from Wedbush and Neil Saunders from GlobalData have provided their insights on Home Depot’s performance. Basham mentioned that interest rate decisions have a greater impact on Home Depot than most retailers. He noted that high interest rates continue to hinder house moves.

High Rates, Low Renovations

Interest rates have an outsized influence on Home Depot’s performance. As rates climb, fewer consumers buy or refinance homes, leading to a decline in major renovations.

Acquiring SRS Distribution

But bright spots do exist for Home Depot. Their acquisition of SRS Distribution contributed $1.3 billion to the top line, helping to end a period of falling sales.

What’s Next for Retail?

Sales of high-ticket items, such as kitchens and batches, have plummeted. To counteract this trend, the company is shifting focus to essential repairs and maintenance. They’re also increasing the promotion of outdoor power equipment rental.

Homeowners Speak Out

Consumers want to wait for major remodels. Home Depot saw a reduced interest in larger projects that usually require financing, such as remodeling kitchens and bathrooms.

Adapting to a Changing Market

Despite the downturn, Home Depot is not standing still. Sales on digital platforms rose, and they fulfilled nearly half of all online orders through their stores. The company’s expansion of same-day delivery services with delivery companies like Instacart is showing encouraging early results.

Local Economies Feel the Pinch

As people spend less on home improvements, the effects ripple beyond corporate earnings. Local workers, small suppliers, contractors, and others can also suffer when the demand for big projects decreases.

Stock Market Reacts

Home Depot’s news has shaken up the stock market, with share prices bouncing around as investors react. Analysts are watching closely, trying to figure out what this means for retail and construction—key parts of the economy.

Home Improvement Sector Overview

Competitors like Lowe’s and local hardware stores feel the same economic pressure. They’re shifting their strategies, focusing on keeping customers and offering more value to ride out the tough times with Home Depot.

Economic Outlook

With interest rates expected to remain high, long-term forecasts for Home Depot remain cautious. Analysts predict only a modest impact on annual sales, even if rates are cut later in the year.

Navigating Home Improvements

Home Depot’s recession strategy involves prioritizing essential repairs and implementing strategic promotions. Will it be enough to sustain them during the economic downturn?

A Resilient Industry in a Challenging Time

Even in a downturn, the home improvement industry can adapt and stay strong. The industry’s ability to bounce back suggests a bright future once the economy stabilizes.

Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Has the push for progress tipped too far into preachiness? Here’s why many Millennials might think so. Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Is It Time Boomers Paid the Price for America’s Economic Inequality?

The American Dream feels more elusive than ever, especially for younger generations. What was once achievable through hard work now faces significant hurdles, from skyrocketing college costs to the challenging pursuit of homeownership. Here’s a look at why it’s tougher for Millennials and Gen Z compared to Baby Boomers. Is It Time Boomers Paid the Price for America’s Economic Inequality?

Rent Crash in California: Landlords Scramble as Prices Take a Hit

California’s rental market is taking a nosedive, with major cities seeing huge drops in rent prices. Rent Crash in California: Landlords Scramble as Prices Take a Hit

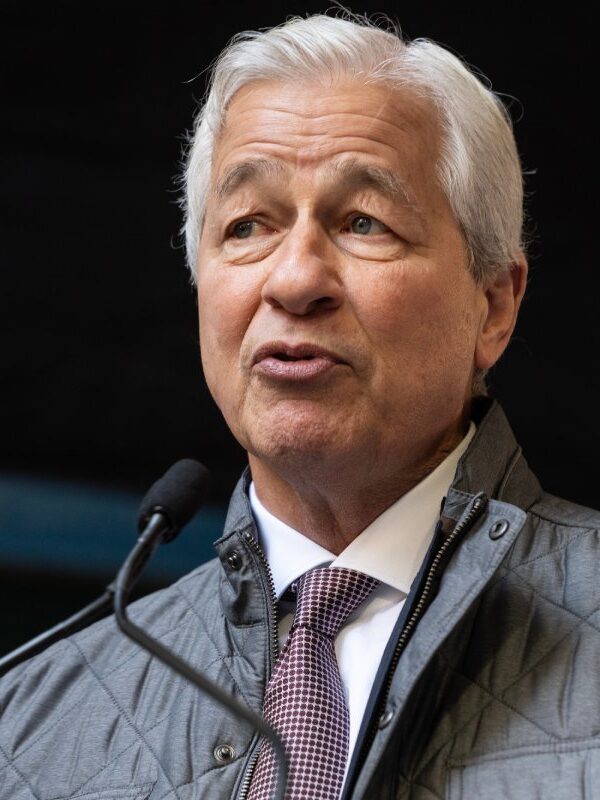

Featured Image Credit: Shutterstock / damann.

The content of this article is for informational purposes only and does not constitute or replace professional advice.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.