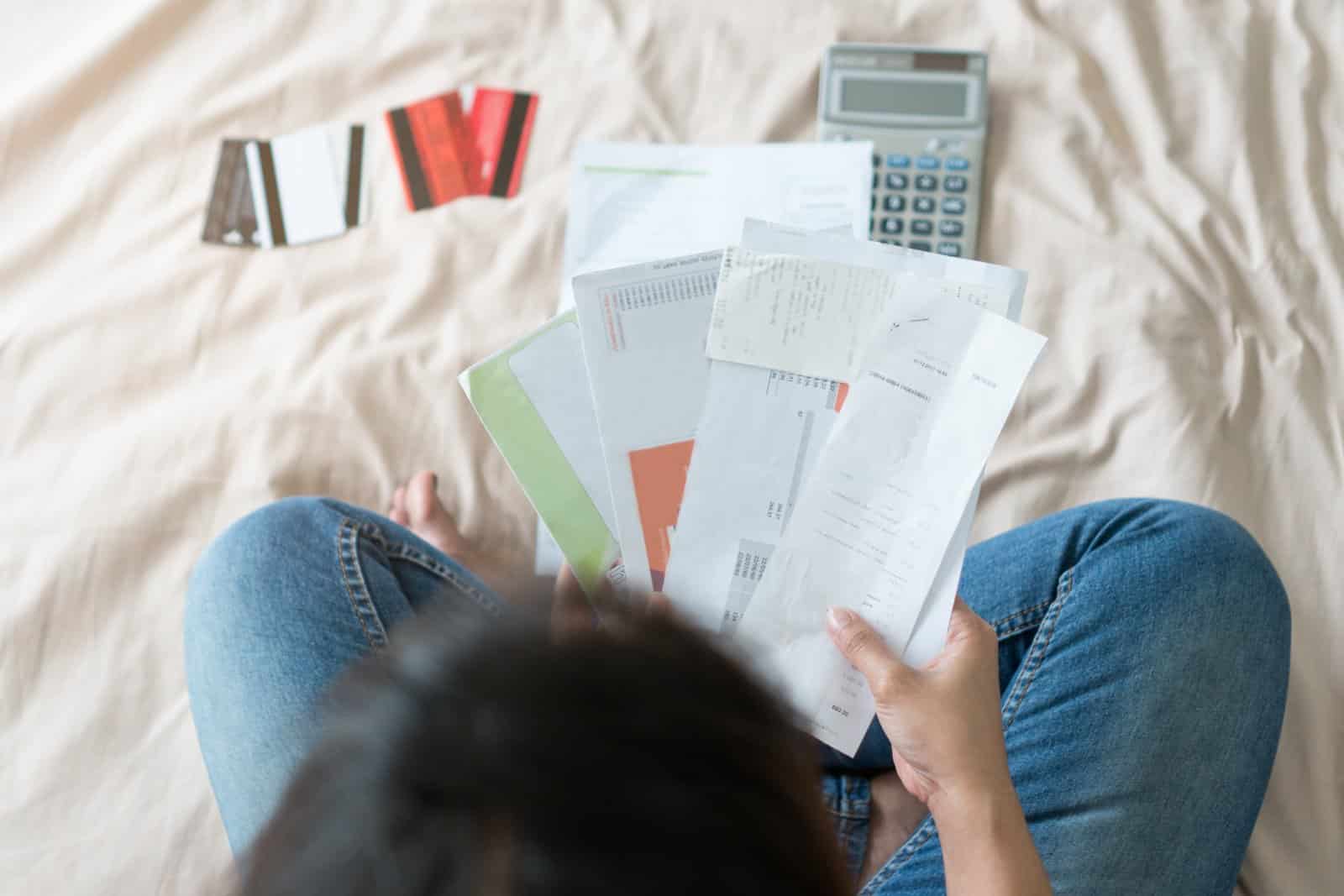

Credit cards are a double-edged sword, offering convenience but often leading to a spiral of debt. Ever wondered why it’s so easy to fall into the credit card trap?

1. Minimum Payment Traps

Credit cards encourage making minimum payments, which mainly cover interest, not principal, keeping you in debt longer.

2. High Interest Rates

High APRs can exponentially increase your debt, especially if you carry a balance month to month.

3. Late Fees and Penalties

Missing a payment can lead to hefty fees and increased interest rates, compounding your debt.

4. Complex Terms and Conditions

Credit card agreements are often dense and confusing, making it hard for consumers to understand the full cost.

5. Reward Programs Temptations

Rewards and points programs incentivize spending more than you might otherwise, leading to higher balances.

6. Credit Limit Increases

Banks often increase your credit limit without request, tempting you to spend beyond your means.

7. Balance Transfer Offers

Introductory 0% APR offers on balance transfers can lead to accumulated debt if not managed carefully after the promo period.

8. Cash Advance Fees

Using your credit card for cash advances comes with high fees and interest rates, increasing your debt quickly.

9. Variable Interest Rates

Variable rates can rise unexpectedly, making your debt more expensive over time.

10. Hidden Fees

Fees for foreign transactions, paper statements, or even account inactivity can add up unnoticed.

11. Targeted Marketing

Credit card companies use sophisticated marketing to target consumers with offers that seem too good to pass up.

12. Psychological Spending Triggers

The ease of “swiping” a card reduces the psychological pain of parting with cash, leading to more spending.

13. Lack of Spending Limits

Without a predefined spending limit, it’s easy to accumulate debt faster than you can pay it off.

14. Deferred Interest Promotions

Buy now, pay later promotions often come with deferred interest, which can pile up if not paid off in time.

15. Multiple Card Offers

Owning multiple cards can lead to higher total debt as you spread spending and balances across them.

16. Automatic Enrollment in Overdraft

Some cards automatically cover overdrafts, leading to unexpected fees and interest charges.

17. Ambiguous Payment Allocation

Payments are often applied to lower-interest balances first, leaving high-interest debt to accrue more interest.

18. Encouragement of Impulse Purchases

Online shopping integrations make impulse purchases too easy, increasing debt quickly.

19. Lack of Financial Education

Many users lack basic financial literacy about credit cards, leading to poor spending and repayment decisions.

20. Billing Cycle Manipulation

Companies may adjust billing cycles subtly to maximize the interest charges if you’re not vigilant.

21. Emotional Targeting

Credit card ads often appeal to emotions and lifestyle aspirations, leading to spending that aligns with desires rather than needs.

Facing the Facts

Understanding these tactics can empower you to use credit cards wisely and avoid the debt trap. It’s about making informed choices and staying ahead of the game.

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

The Path to Self-Discovery: 15 Steps to Finding Your True Self

Embarking on a journey of self-discovery goes beyond mere introspection; it requires actionable steps backed by research to uncover your authentic self. Here are 15 evidence-based strategies and practical steps to get started on each. The Path to Self-Discovery: 15 Steps to Finding Your True Self

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Grow Every Day: 14 Habits for Tangible Personal Progress

Ready to take your personal growth journey to the next level? Incorporating small, tangible practices into your daily routine can lead to significant positive changes in your life. From expressing gratitude to nurturing connections with loved ones, these 14 daily habits are designed to empower you to thrive and flourish. Let’s dive in and elevate your life one day at a time! Grow Every Day: 14 Habits for Tangible Personal Progress

The post Swipe Carefully! 21 Ways Your Credit Card Is Basically Your Debt’s Best Friend first appeared on Not Your Boss Babe.

Featured Image Credit: Shutterstock / Krakenimages.com.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply