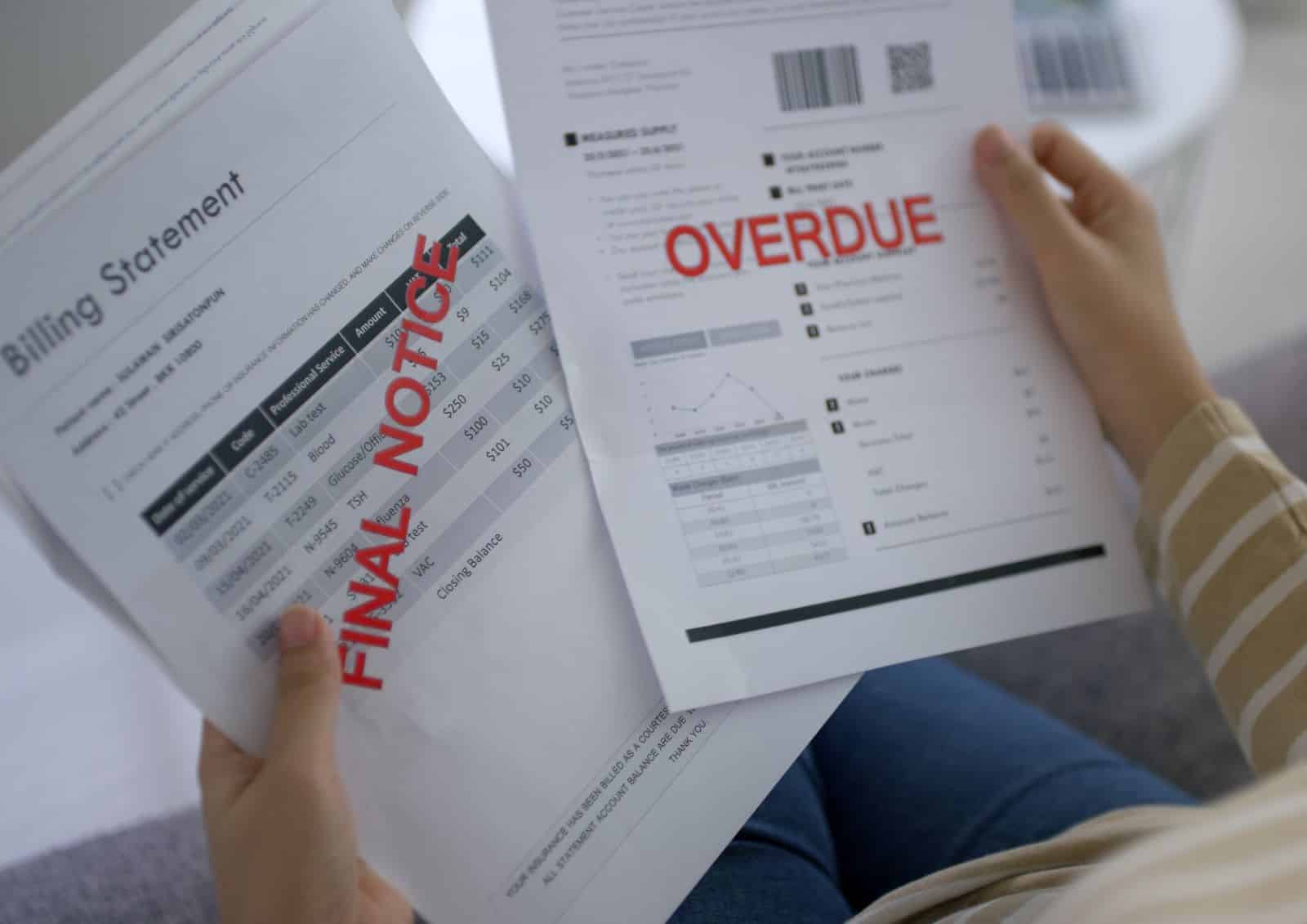

Americans are borrowing more than they can repay, shining a light on how inflation and interest rates are affecting borrowers across the country.

Maxing Out

A growing number of Americans are maxing out their credit cards, with nearly a fifth of borrowers using most of their available credit, according to a new report by the New York Federal Reserve.

New York Fed Report

The report, which was issued by the Center for Microeconomic Data, showed that 8.9% of US credit card holders had fallen behind on repayments, also known as “serious delinquency” of 90 days or more, in the first quarter of 2024.

Highest in 10 Years

This is up from the 8.5% recorded in the fourth quarter of 2023. It is the highest number of delinquent borrowers since 2011.

Staggering Household Debt

It also showed that household debt has risen by 1.1% in the same period. US household debt now sits at $17.69 trillion.

18% Qualify As “Maxed-Out”

While approximately half of all credit card borrowers used less than 20% of their available credit, 18% of borrowers used “at least 90 percent of their available credit,” leaving them in the “maxed-out” category.

A Bleak Economic Outlook

The report findings show a bleak outlook for many US households and are a reflection of record-high inflation, interest rates, and a cooling labor market, all of which have taken their toll on bank accounts over the last few years.

Less Savings

What’s more, the increase in credit card debt means more Americans will have less savings to rely on, pushing them further into financial insecurity and potential poverty.

Signs of Financial Stress

The rise in serious credit card delinquency is a signal of concerning financial stress amongst everyday Americans. And while it is rising across the board in terms of age groups, it is especially bad for younger borrowers.

Experts Weigh in

“An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households,” said Joelle Scally, who works for the household and public policy research division at the Fed.

Young and Low-Income People Most Affected

Overall, younger people and people who live in “low-income” areas are more likely to have maxed-out credit cards than older borrowers, or borrowers in the same age group who reside in higher-income areas.

15% of Gen Z Borrowers

15.3% of Gen Z credit card users were in the “maxed-out” category, using more than 90% of available credit.

The Highest of Every Generation

This is the highest amount of “maxed-out” borrowers for any generation, with Millenials coming in at 12.1%, Gen X at 9.6%, and Baby Boomers at a very low 4.8%.

A Matter of Credit Limits

However, these rates can likely be explained by Gen Z’s much lower median credit limit of $4,500, compared to Boomer’s $22,000 median limit.

Sheer Drop from Pandemic Lows

Since late 2021, credit card debt and delinquencies have been on the rise, in a sheer drop from the historic lows for card borrowers during the pandemic.

Record High Average Credit Rate and Balance

The average credit card rate has hit a record high of 21.6%, and the average card balance reached $6,360 at the end of 2023, another all-time high.

People Leaning On Their Cards

According to Matt Schultz, a credit analyst at online lending marketplace LendingTree, “There’s no question that people are leaning more on their cards to help them as prices continue to rise.”

In a Debt Trap

But with record high interest rates, maxing out credit cards and making late payments can easily trap people, particularly young people, in a kind of debt trap. It can take years to pay off the debt, and borrowers may end up repaying more in interest than they initially borrowed.

Going “From Bad to Worse”

“It’s kind of gone from bad to worse,” said Bankrate industry analyst Tedd Rossman. “You can easily become trapped in a very dangerous debt cycle,”

Unlikely to Drop Any Time Soon

According to industry experts, we are unlikely to see these figures drop for the foreseeable future as inflation and interest rates remain high. In fact, it is likely to get worse.

The Number One Job for Borrowers

“The thing that’s most important is to pay that balance down as soon as you possibly can,” is Schulz’s advice. “That’s job number one for anyone with a credit card.”

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

The Path to Self-Discovery: 15 Steps to Finding Your True Self

Embarking on a journey of self-discovery goes beyond mere introspection; it requires actionable steps backed by research to uncover your authentic self. Here are 15 evidence-based strategies and practical steps to get started on each. The Path to Self-Discovery: 15 Steps to Finding Your True Self

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Grow Every Day: 14 Habits for Tangible Personal Progress

Ready to take your personal growth journey to the next level? Incorporating small, tangible practices into your daily routine can lead to significant positive changes in your life. From expressing gratitude to nurturing connections with loved ones, these 14 daily habits are designed to empower you to thrive and flourish. Let’s dive in and elevate your life one day at a time! Grow Every Day: 14 Habits for Tangible Personal Progress

The post Americans Are Maxing Out Credit Card Limits Like Never Before first appeared on Not Your Boss Babe.

Featured Image Credit: Shutterstock / ViDI Studio.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply