In an unexpected twist, both Kamala Harris and Donald Trump agree on a new proposal: no taxes on tips for service workers. It’s a rare moment of unity in our polarized political environment. But here’s the kicker—it might sound great at first, but this idea is more complicated and less fair than it appears.

The Proposal’s Appeal

The idea is simple: let service workers keep every dollar of their hard-earned tips without the IRS taking a cut. Who wouldn’t love that? It’s a proposal that resonates with many Americans, especially those in the service industry who rely on tips to make ends meet.

Who’s Pushing for It?

Both Vice President Kamala Harris and former President Donald Trump have shown support for this idea, signaling a rare moment of bipartisan agreement. They argue it’s about fairness and helping workers keep more of their earnings in a tough economy.

The Reality of Service Work

For many service workers, tips make up a significant portion of their income. According to the Bureau of Labor Statistics, the median hourly wage for waitstaff in the U.S. is about $12, which includes tips. Without tips, many workers would struggle to survive.

What’s Fair?

While the idea of no taxes on tips sounds fair, it raises some serious questions about tax fairness and equity. If tips are exempt from taxes, it might mean other forms of income, like salaries and wages, could bear a larger tax burden. Is that fair to everyone?

A Break for Businesses?

This proposal could also give businesses a break. If tips aren’t taxed, some argue that businesses might feel less pressure to offer higher base wages, potentially keeping workers dependent on tips to make a living.

Economic Impact

Tax experts worry about the potential loss of revenue for government services. Tips currently contribute to the tax base, and exempting them could lead to significant losses. According to the Joint Committee on Taxation, this could mean billions in lost revenue each year.

The Hidden Cost

While service workers might take home more money in the short term, the long-term effects could be more complex. Without taxes on tips, there’s less revenue for services like healthcare, education, and infrastructure, which everyone relies on.

Unintended Consequences

Another concern is the potential for wage stagnation. If employers know that tips are tax-free, they might feel less pressure to raise base wages, leaving workers reliant on tips that can vary widely from day to day.

A Simple Solution?

While “no taxes on tips” seems like an easy fix, it overlooks the complexities of the tax system. A better solution might involve raising the minimum wage for service workers or offering tax credits that directly benefit low-income earners.

The View from the Left

Many left-leaning economists argue that rather than focusing on tips, we should be pushing for a living wage. They point out that relying on tips keeps workers in a precarious position, dependent on the generosity of customers rather than stable, fair wages.

What About the IRS?

Removing taxes on tips would also complicate the IRS’s job. Tips are notoriously hard to track, and this change could lead to more tax evasion and fraud, putting a strain on enforcement resources.

A Populist Appeal

Both Trump and Harris know that this proposal has a populist appeal. It’s easy to support an idea that seems to give more money directly to workers. But is this really the best way to support the working class?

Public Reaction

The public is divided. Some see it as a much-needed break for low-income workers, while others worry about the broader economic implications. The debate highlights the ongoing struggle to balance fair wages, taxes, and government services.

The Bigger Picture

Ultimately, the “no taxes on tips” proposal is a small part of a much larger conversation about income inequality, fair wages, and tax fairness. It’s a reminder that there are no easy solutions when it comes to balancing individual needs with the common good.

Looking Ahead

As this proposal gains traction, it’s important to consider not just the immediate benefits, but the long-term consequences. It’s a debate that’s sure to continue, as Americans tackle the best ways to support service workers while maintaining a fair and functioning tax system

Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Has the push for progress tipped too far into preachiness? Here’s why many Millennials might think so. Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Is It Time Boomers Paid the Price for America’s Economic Inequality?

The American Dream feels more elusive than ever, especially for younger generations. What was once achievable through hard work now faces significant hurdles, from skyrocketing college costs to the challenging pursuit of homeownership. Here’s a look at why it’s tougher for Millennials and Gen Z compared to Baby Boomers. Is It Time Boomers Paid the Price for America’s Economic Inequality?

Rent Crash in California: Landlords Scramble as Prices Take a Hit

California’s rental market is taking a nosedive, with major cities seeing huge drops in rent prices. Rent Crash in California: Landlords Scramble as Prices Take a Hit

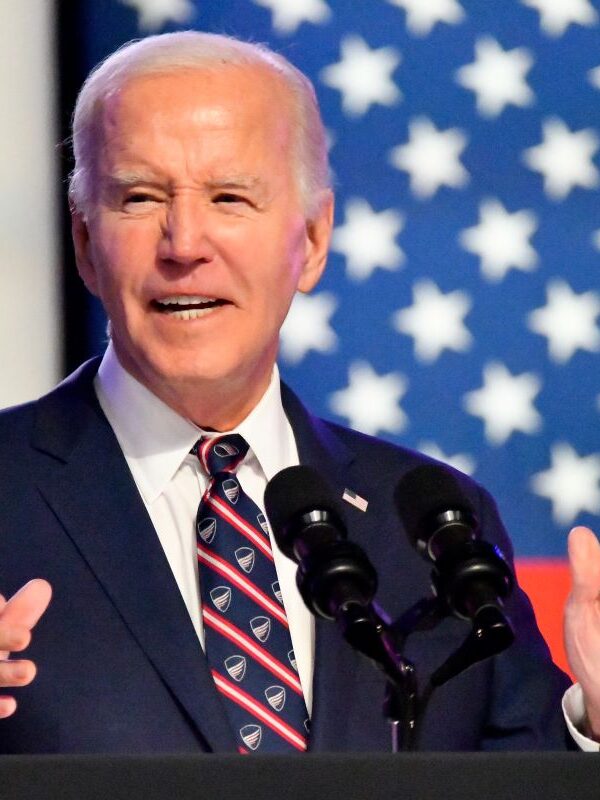

Featured Image Credit: Shutterstock / lunopark.

The content of this article is for informational purposes only and does not constitute or replace professional advice.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.