California residents might soon have another financial hurdle to worry about—a proposed new tax on home and car insurance. As if the cost of living wasn’t already high enough, this potential tax could further strain household budgets across the state.

The Proposal: What’s on the Table?

The new tax would apply directly to insurance premiums, potentially driving up the cost of both home and car insurance. State lawmakers argue that this could generate much-needed revenue, but many Californians are skeptical.

Why Now?

California’s budget has been under pressure for years, and state officials are looking for new ways to fill the gaps. With public services needing funding, a tax on insurance might seem like a straightforward solution to some, but it raises serious concerns for others.

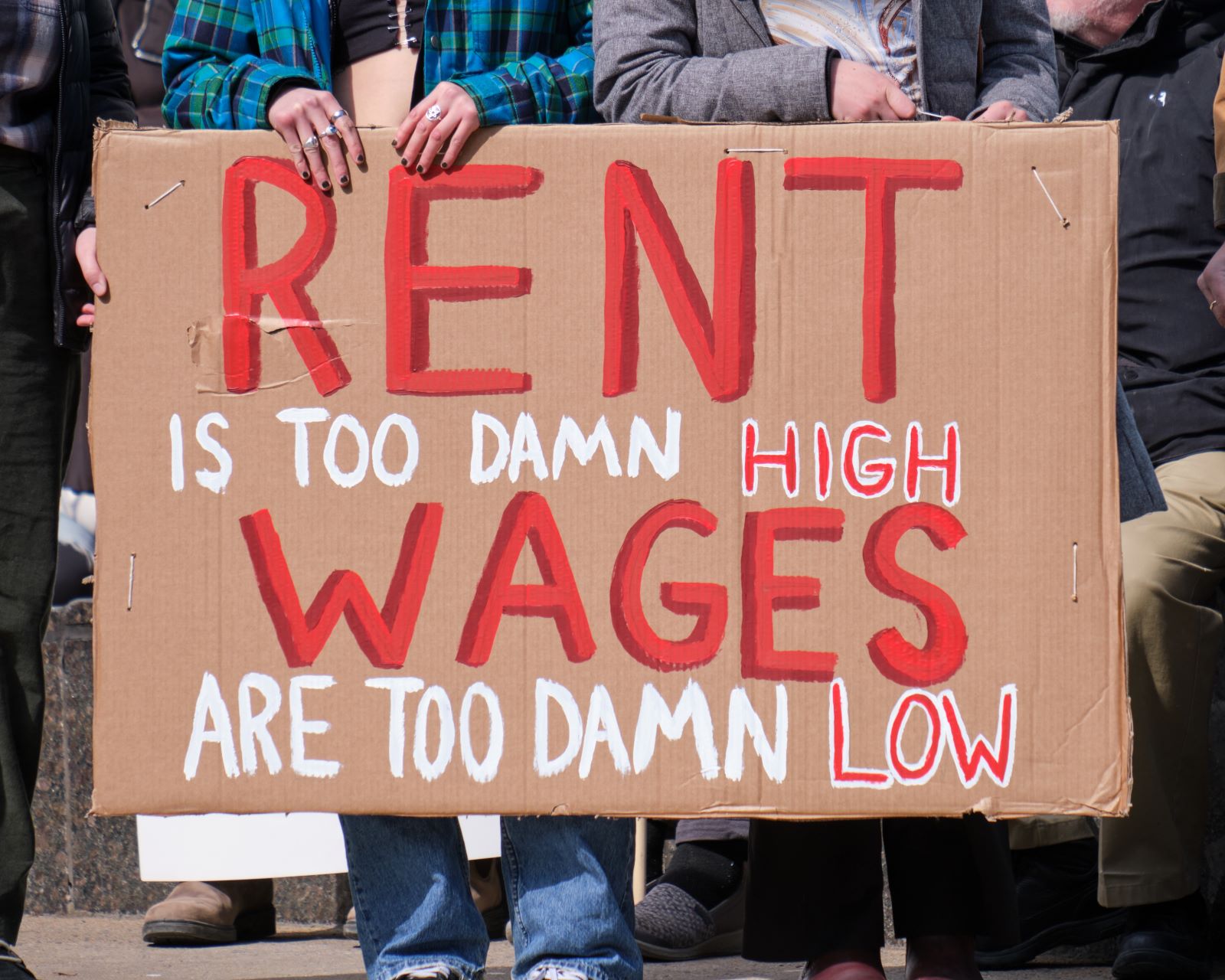

Public Concerns Grow

The proposal has sparked concern among California residents, who are already dealing with rising living costs. This potential tax adds another layer of financial worry, especially for those struggling to make ends meet.

Insurance Companies Push Back

Insurance companies are not on board with the idea. They argue that adding more taxes to premiums will make insurance less affordable and could lead to people reducing their coverage—something that could have serious consequences in the event of disasters.

Financial Impact on Households

If this tax is implemented, it could significantly increase the cost of insurance. With home insurance premiums in California already high, this new tax could push costs to an unsustainable level for many families.

Supporters Say It’s Necessary

Supporters of the tax argue that the additional revenue is crucial for funding state programs and services. They claim that the tax could help support everything from education to infrastructure projects.

Who Will Be Hit the Hardest?

The burden of this tax would likely fall hardest on low- to middle-income families. For those who are already struggling to afford insurance, this added cost could be the final straw.

Lawmakers Debate the Proposal

California legislators are divided on the issue. Some believe the tax is a necessary step to ensure the state’s financial health, while others argue it’s an unfair burden on working families.

Consumer Advocacy Groups Speak Out

Consumer advocacy groups are rallying against the tax. They warn that it could disproportionately affect vulnerable populations and argue that there must be better ways to raise revenue without harming those who can least afford it.

Governor’s Position

Governor Gavin Newsom has yet to take a firm stance on the proposed tax. However, he has expressed concern about the rising costs Californians are facing and emphasized the need for solutions that do not disproportionately impact the middle class.

Potential Alternatives

As the debate continues, some lawmakers are suggesting alternative ways to raise revenue, such as closing corporate tax loopholes or increasing taxes on luxury goods, which might be more equitable solutions.

Economic Implications

The broader economic implications of this tax could be significant. If insurance costs rise, we could see a ripple effect across the economy, with consumers spending less on other goods and services.

The Role of Public Opinion

Public opinion will play a critical role in the outcome of this proposal. Californians are encouraged to voice their concerns to their representatives and participate in the democratic process to influence the decision.

What Happens Next?

The proposal is still under consideration, and a final decision has not been made. It’s crucial for residents to stay informed and involved in the process as the debate unfolds.

The Bottom Line

California’s proposed tax on home and car insurance is a contentious issue with potentially significant consequences. As the state searches for ways to balance its budget, the burden may fall on residents who are already feeling the financial squeeze.

Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Has the push for progress tipped too far into preachiness? Here’s why many Millennials might think so. Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Is It Time Boomers Paid the Price for America’s Economic Inequality?

The American Dream feels more elusive than ever, especially for younger generations. What was once achievable through hard work now faces significant hurdles, from skyrocketing college costs to the challenging pursuit of homeownership. Here’s a look at why it’s tougher for Millennials and Gen Z compared to Baby Boomers. Is It Time Boomers Paid the Price for America’s Economic Inequality?

Rent Crash in California: Landlords Scramble as Prices Take a Hit

California’s rental market is taking a nosedive, with major cities seeing huge drops in rent prices. Rent Crash in California: Landlords Scramble as Prices Take a Hit

Featured Image Credit: Shutterstock / PeopleImages.com – Yuri A.

The content of this article is for informational purposes only and does not constitute or replace professional advice.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.