Could ditching the income tax for tariffs make economic sense, or is it a recipe for financial upheaval?

The Financial Feasibility Is Questionable

Trump’s radical proposal to replace income tax with tariffs seems financially unfeasible. The current income tax system generates around $2 trillion annually, which would require extremely high tariffs to match—estimates suggest tariffs would need to be around 69.9% just to come close. However, accounting for likely noncompliance and other economic behaviors, the revenue from such tariffs could fall significantly short, potentially reaching only about $560 billion.

Historical Context Raises Doubts

While tariffs were the main revenue source for the U.S. government until the early 20th century, relying on them today would be impractical. The U.S. government’s budget as a percentage of GDP is now much larger than when tariffs last funded the majority of government spending. For example, major categories like Social Security, Medicare, and defense spending alone account for more than 14% of GDP today.

Consumers Would Bear the Brunt

Tariffs might sound like a good way to tax foreign entities, but they actually end up costing American businesses and consumers. Importers directly pay these duties, often passing these costs onto consumers. Economic analyses of recent tariffs show nearly a complete pass-through of costs to U.S. consumers, which could lead to higher overall prices for goods.

Negative Impact on the Economy

The overall economic impact of switching to a tariff-based system could be detrimental. Higher tariffs generally lead to increased consumer prices, affecting spending and economic growth. Moreover, while tariffs could theoretically protect certain jobs, they tend to have a net negative impact on the economy due to higher prices and reduced competitiveness.

Tax Cuts vs. Economic Growth

Trump’s plan also suggests cutting the corporate income tax rate significantly, which might spur some economic growth. However, the plan would also lead to a substantial decrease in federal revenue—projected at nearly $12 trillion over ten years on a static basis. Even accounting for dynamic economic growth, the shortfall would be over $10 trillion.

The Rich Benefit More

The tax plan is likely to disproportionately benefit wealthier individuals, as it proposes cuts in income taxes and the elimination of the estate tax. These changes could significantly increase the after-tax income of high earners, further widening income inequality.

Potential Job Creation is Uncertain

Although the plan claims to potentially create millions of jobs due to economic growth spurred by tax cuts, the actual realization of these jobs is uncertain and depends heavily on how businesses and consumers respond to the broader economic conditions.

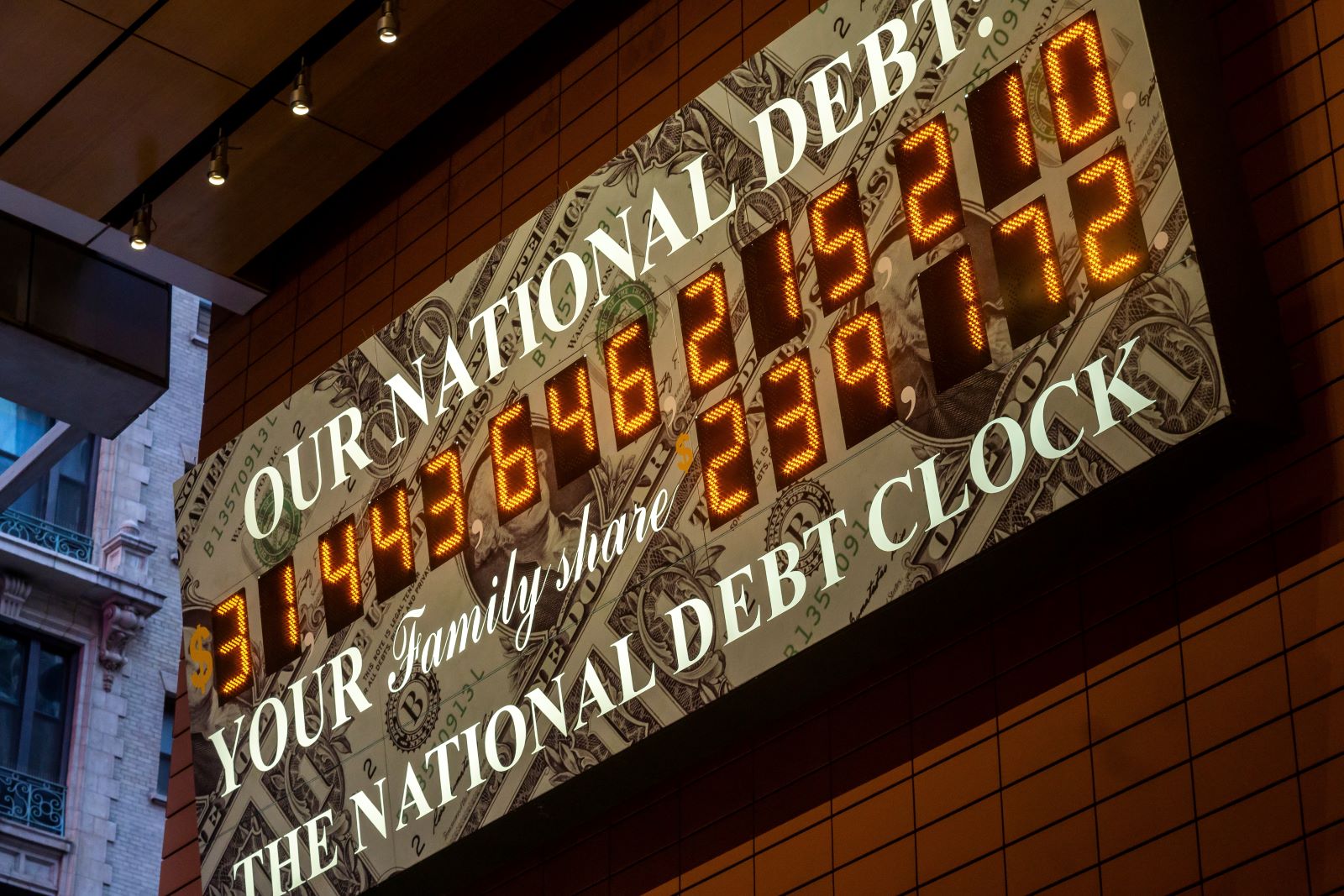

Budget Deficit Concerns

The drastic reduction in federal revenues could lead to an increase in the national debt, raising concerns about the long-term fiscal health of the country, especially in light of ongoing expenses and obligations such as Medicare, Social Security, and defense.

The Practicality of Implementation

Implementing such sweeping changes to the tax code would require extensive legislative support, which may be difficult to secure. The plan’s controversial nature could lead to significant political hurdles.

Impact on U.S. Global Competitiveness

Significant tax changes could affect the United States’ competitiveness on the global stage. Lower corporate taxes might attract foreign investment, but higher tariffs could alienate trading partners and lead to retaliatory measures.

Influence on Consumer Behavior

The removal of income tax might initially increase disposable income for some, leading to higher spending. However, the introduction of high tariffs could offset these gains by increasing the prices of imported goods.

Effect on Small Businesses

While lowering corporate taxes could benefit large corporations, small businesses might not gain as much. They could face higher costs due to tariffs and may not benefit substantially from income tax cuts if they’re already operating at lower profit margins.

Long-Term Economic Shifts

The tax changes could encourage certain industries while discouraging others, leading to long-term shifts in the economic landscape. Industries reliant on imported goods might suffer, whereas those that are primarily domestic could benefit.

Impact on Government Services

Reduced federal revenue might necessitate cuts to essential government services or the implementation of alternative forms of taxation, which could prove unpopular and disruptive.

Changes in Investment Patterns

The proposed changes could shift investment patterns, potentially favoring certain sectors over others. This could have wide-reaching effects on the economy, influencing everything from real estate to technology investments.

Legal and Regulatory Challenges

The plan could face significant legal and regulatory challenges, which could delay or prevent the implementation of some of its components, adding uncertainty to the economic environment.

Social and Economic Equity Issues

The proposed tax plan might exacerbate social and economic disparities, as lower-income families might not benefit as much from the tax cuts compared to wealthier individuals.

Historical Precedents and Lessons

Looking at historical precedents, significant changes to tax systems have often led to unexpected economic shifts and required subsequent adjustments to address unforeseen consequences.

The Million-Dollar Question

With so much at stake, it remains to be seen if eliminating the income tax in favor of steep tariffs would really serve the average American, or just lead to a heavier financial burden.

Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Has the push for progress tipped too far into preachiness? Here’s why many Millennials might think so. Millennials Are Over It: 25 Reasons Woke Culture Is Losing Its Charm

Is It Time Boomers Paid the Price for America’s Economic Inequality?

The American Dream feels more elusive than ever, especially for younger generations. What was once achievable through hard work now faces significant hurdles, from skyrocketing college costs to the challenging pursuit of homeownership. Here’s a look at why it’s tougher for Millennials and Gen Z compared to Baby Boomers. Is It Time Boomers Paid the Price for America’s Economic Inequality?

Rent Crash in California: Landlords Scramble as Prices Take a Hit

California’s rental market is taking a nosedive, with major cities seeing huge drops in rent prices. Rent Crash in California: Landlords Scramble as Prices Take a Hit

Featured Image Credit: Shutterstock / Christopher Halloran.

The content of this article is for informational purposes only and does not constitute or replace professional advice.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply