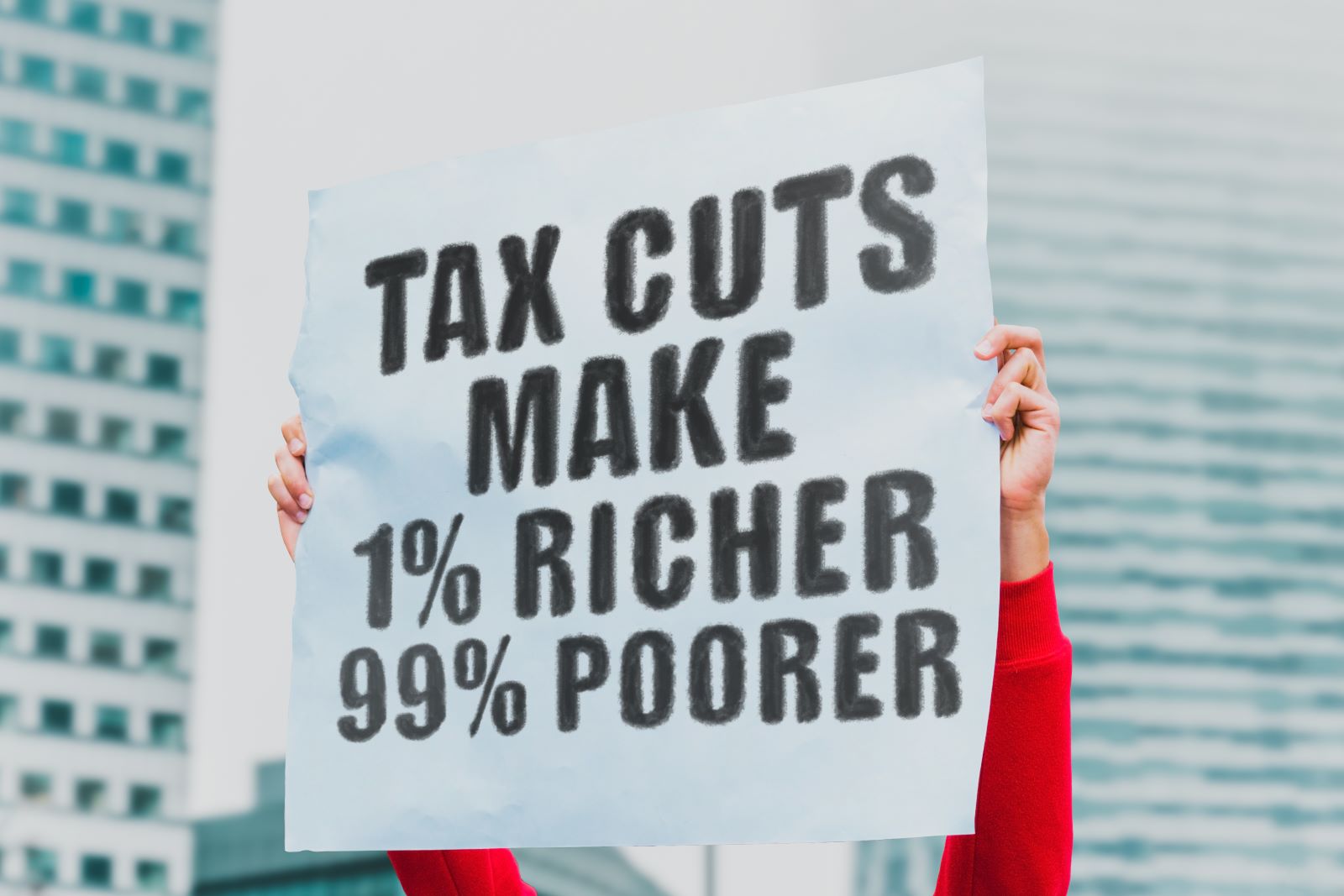

It’s high time the wealthiest Americans started contributing their fair share to the nation’s coffers. Here are 21 essential reforms to ensure the rich stop dodging taxes.

1. Implement a Wealth Tax

A 2% annual tax on wealth over $50 million, as proposed by Senator Elizabeth Warren, could generate $2.75 trillion over ten years. This would impact around 75,000 American households.

2. Raise the Top Marginal Income Tax Rate

Increasing the top marginal tax rate from 37% to 39.6%, as it was pre-2017, could raise an additional $100 billion over ten years, affecting those earning over $518,400.

3. Close the Carried Interest Loophole

This loophole allows private equity and hedge fund managers to pay a lower capital gains rate instead of ordinary income tax. Closing it could raise $18 billion over ten years.

4. Increase Capital Gains Tax Rates

Aligning capital gains tax rates with ordinary income rates for those earning over $1 million could raise $370 billion over ten years, affecting the top 0.3% of taxpayers.

5. Eliminate the Step-Up in Basis

Currently, heirs don’t pay capital gains taxes on inherited assets’ appreciation. Eliminating this provision could raise $113 billion over ten years.

6. Cap Itemized Deductions

Limiting itemized deductions to 28% for higher earners could generate $650 billion over ten years, primarily affecting those earning above $400,000 annually.

7. Enforce a Minimum Tax on Corporate Profits

A 15% minimum tax on corporate book income for companies with profits over $100 million, as proposed in President Biden’s plan, could raise $318 billion over ten years.

8. Reform Global Intangible Low-Taxed Income (GILTI)

Increasing the GILTI rate from 10.5% to 21% could raise $533 billion over ten years, targeting profits shifted abroad by multinational corporations.

9. Increase IRS Funding for Audits

Doubling the IRS enforcement budget could raise $700 billion over ten years by increasing audit rates for high-income individuals and large corporations.

10. Implement a Financial Transactions Tax

A 0.1% tax on stock, bond, and derivative transactions could raise $777 billion over ten years, mainly affecting high-frequency traders and wealthy investors.

11. Repeal the Tax Cuts and Jobs Act

Repealing the 2017 Tax Cuts and Jobs Act for individuals earning over $200,000 could raise $1.5 trillion over ten years, reversing tax breaks that primarily benefited the wealthy.

12. Institute a Real Estate Transfer Tax

A 1% tax on the sale of properties over $2 million could generate $65 billion over ten years, targeting luxury real estate transactions.

13. End Offshore Tax Havens

Legislating against profit shifting to tax havens could raise $600 billion over ten years, ensuring corporations and wealthy individuals pay taxes on profits earned in the U.S.

14. Strengthen Estate Taxes

Reducing the estate tax exemption from $11.7 million to $3.5 million and increasing the top rate to 45% could raise $271 billion over ten years.

15. Introduce a CEO Pay Ratio Tax

A surcharge on corporations with CEO pay ratios over 100:1 could raise $150 billion over ten years, discouraging excessive executive compensation.

16. Reinstate the Alternative Minimum Tax (AMT)

Reinstating the AMT for individuals earning over $1 million could raise $428 billion over ten years, ensuring high earners pay a minimum amount of tax.

17. Increase Taxes on Dividends

Taxing dividends as ordinary income for those earning over $1 million could raise $240 billion over ten years, targeting the wealthy who derive significant income from investments.

18. Limit Pass-Through Business Income Deduction

Capping the 20% pass-through deduction at $400,000 could raise $150 billion over ten years, preventing high-income individuals from disproportionately benefiting.

19. Strengthen Reporting Requirements

Requiring financial institutions to report account balances and transactions could raise $460 billion over ten years by reducing underreporting of income.

20. Tax Stock Buybacks

A 2% tax on corporate stock buybacks could raise $22 billion annually, discouraging companies from artificially inflating stock prices to benefit executives and shareholders.

21. Implement a Luxury Goods Tax

A 10% tax on luxury goods such as yachts, private jets, and high-end cars could raise $100 billion over ten years, targeting conspicuous consumption by the wealthy.

Time to Pay Up

These reforms could generate trillions in revenue, helping to fund critical public services and reduce inequality. It’s time for the wealthiest Americans to contribute their fair share to society.

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Featured Image Credit: Shutterstock / Heidi Besen.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply