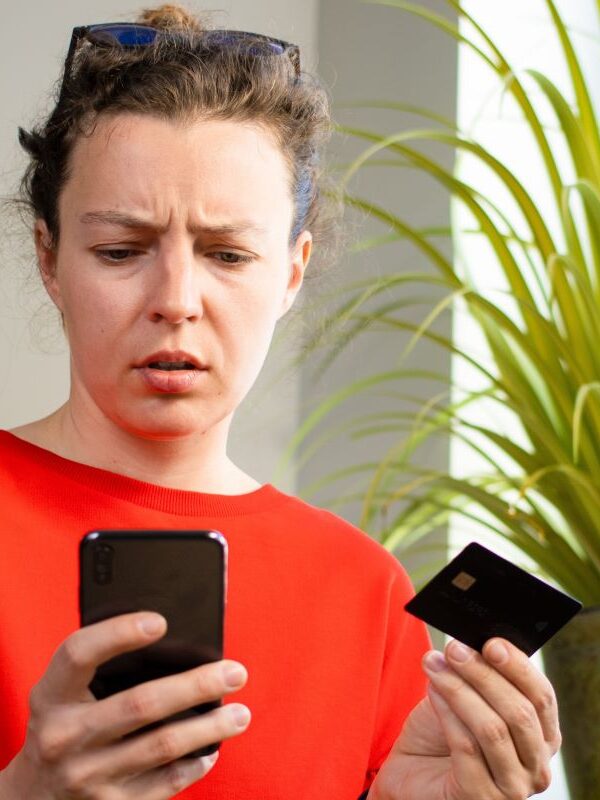

Do you bank with JPMorgan Chase? You might be in for a shock.

Chase Bank’s Warning to Customers

Attention Chase Bank customers: it might be time to hold onto your wallets after the head of Chase’s latest comments.

The Potential End of Free Banking

Brace yourself because, according to Marianne Lake, new banking rules that will cap overdrafts and late fees could mean that Americans across the nation will soon have to start paying for their bank accounts. Yep, you read that right.

Chase’s Market Position

Chase is arguably the country’s biggest bank – at least when it comes to the sheer number of customers – and one of the largest credit card issuers, and this news has a lot of people within the finance sector worried.

New Regulations and Their Impact

So, what’s the deal? According to Lake, new regulations capping fees on overdrafts and late payments are going to make everyday banking a lot more expensive.

Marianne Lake’s Statement

“The changes will be broad, sweeping, and significant,” Lake said. “The people who will be most impacted are the ones who can least afford to be, and access to credit will be harder to get.”

Chase’s Response to New Regulations

Chase plans to pass these costs on to customers by charging for services like checking accounts and portfolio management, which have been free until now. And don’t think Chase is the only one – Lake thinks other banks will quickly start doing the same.

Past Context

Banks have a history of trying to pass on costs to customers, although a lot of the time they end up backtracking.

The 2010 Debit Card Fee Controversy

Back in 2010, after the financial crisis, banks warned they’d start charging for debit cards because of new caps on card charges. But when customers threatened to take their business elsewhere, banks gave up on the plans.

Skepticism from Economic Experts

Dennis Kelleher from Better Markets, an economic think tank, thinks banks are just bluffing again. “The banks say that their only option is to pass on their costs to customers, but that’s not true,” he said. Banks, he argues, are just trying to make more profit while pretending it’s for the customer’s own good.

Potential Impact on Household Budgets

This time, the proposed regulations could seriously stretch household budgets across the nation.

Background To The Controversy

A quick bit of background before we go further: The Consumer Financial Protection Bureau (CFPB) is looking to cap credit card late fees at $8 and overdraft fees at $3. They also want to limit debit card fees and how much banks can charge companies like Venmo and CashApp for accessing and using your data.

New Capital Rules for Banks

There are also new capital rules in the pipeline, which could require banks to hold more reserves against mortgages and credit-card loans – making lending more expensive.

Legal Challenges

Banks aren’t taking these new rules lying down. They’ve launched appeals and lawsuits, mostly in Texas (a popular spot for challenging Biden administration regulations.)

What Else Are They Doing?

A group of banks is currently appealing the CFPB’s late fee cap for credit cards, and trade organizations are trying to stop changes to the Community Reinvestment Act, which requires banks to serve low-income communities.

Uncertainty About It All

There’s a chance some of these regulations could be watered down or even thrown out if there’s an upset at the next election.

The End of Free Services at Chase?

But for now, Lake warns that many services customers have come to expect for free at Chase – like checking accounts, credit score trackers, and financial planning tools – may soon come with a price tag. “It is not practical for many of the services to be free if we won’t be able to draw from those profit pools,” she explained.

Preemptive Actions

Even though the late fee cap isn’t law yet, credit card companies are already gearing up to pass on costs. Chase, for instance, has plans to hike up interest rates and be more strict with approving credit-card loans.

Potential Winners

In the long run, big banks like Chase might come out on top. These regulation changes give these bigger, more efficient banking behemoths the opportunity to charge for services they’ve been giving away for years.

New Profit Sources

These banks can also compensate for any loss in profits from consumer banking with new profits from wealth management and investment banking. Smaller regional banks, though, might have a tougher time adapting.

Competition Could Bring Relief

But there is some good news for customers – passing on those costs might not be as easy as it sounds. Nowadays, with the rise of Fintech banks, competition is insanely fierce. These bigger banks might have to keep some services free just to stay in the game and attract customers.

Preparing for Changes

Regardless of what happens, it looks like Chase customers should be ready for some changes.

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Featured Image Credit: Shutterstock / Katherine Welles.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply