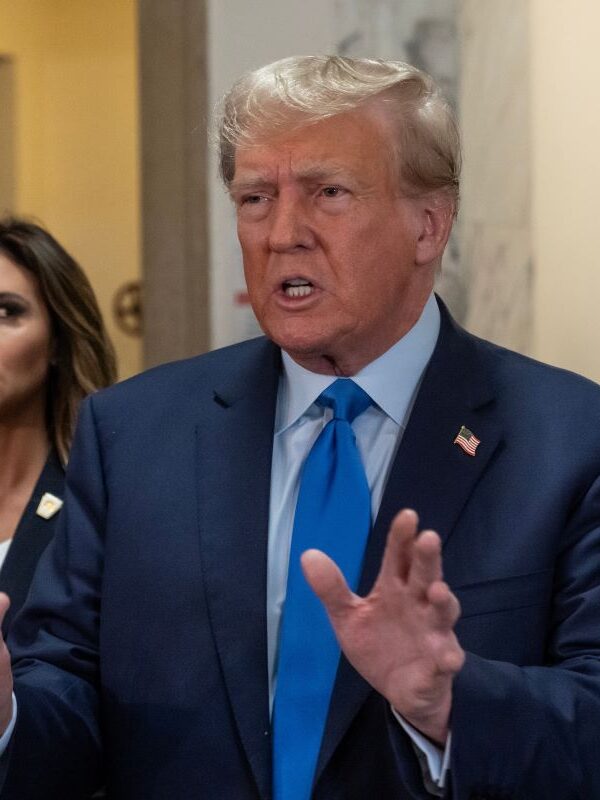

Dave Ramsey has lashed out at younger critics of his financial advice, calling them “just awful” in an explosive Fox interview.

Ramsey Faces Youth Critics

In a recent interview with Fox Business, American financial advisor and radio personality Dave Ramsey blasted his Gen Z and Millenial critics, who have taken to social media platforms like TikTok to trash Ramsey’s financial advice.

Unrealistic Advice?

Young Americans have taken to these platforms to call the Ramsey Solutions CEO’s financial advice “a bunch of crap,” claiming that it is not realistic for most younger people in the current economic system.

“They’re Just Awful”

“There’s a segment of them [younger generations] that just s****. They’re just awful,” Ramsey told The Bottom Line co-hosts Dagen McDowell and Sean Duffy in response to questions about this recent feedback.

His Critics “Can’t Figure It Out”

“I mean, their participation trophy, they live in their mother’s basement, and they can’t figure out why they can’t buy a house because they don’t work, you know, stuff like that,” he continued.

Claims of Problematic Attitudes

Ramsey has pointed out these perceived behaviors and attitudes as problematic in younger people and part of the reason some struggle financially.

Not All Bad

However, it wasn’t all backlash and negativity. Ramsey also offered praise for a segment of Gen Z and Millenials, who he called “excellent generations” who are “very good with money.”

Some Are “Very Serious”

“What we’re seeing with both of them is there is a segment of them that is very serious and very good with their money,” he told the Fox co-hosts.

Believing In It

“They believe in it. They believe in saving. They believe in investing. They believe in the free enterprise system,” he continued.

Wall Street Journal Gets Involved

The back-and-forth between Ramsey and younger netizens was documented recently in a piece by the Wall Street Journal titled ‘Dave Ramsey Tells Millions What to Do With Their Money. People Under 40 Say He’s Wrong.’

Frugal Tips

It covered Ramsey’s financial advice to younger generations on his radio shows and podcasts, urging them to avoid debt, use cash over credit, and live as frugally as possible.

Is It Unrealistic?

But it also presented a flood of young Americans who claim that Ramsey’s advice is unrealistic, unattainable, and out of touch with the economic realities that younger generations face.

Trending Hashtags for Ramsey

The topic became so heated that the hashtag #daveramseywouldntapprove began trending on social media, accompanied by videos of young people doing things that went against Ramsey’s message of extreme frugality.

Compounding Factors for Young America

Younger people pointed to higher rates of inflation that have outpaced wages and continually climbing cost of living and housing prices that have left the average Millenial and Gen Z unable to afford a typical home.

He’s Missing the Context

“What Dave Ramsey really misses is any kind of social context,” one Gen Z TikToker told the Wall Street Journal.

“I’m Good Clickbait”

Ramsey waved away the growing public disagreement, arguing that much of the arguments were being used to feed media headlines. “I’m really good clickbait,” he said.

Lack of Personal Responsibility

He also claimed that for many of his younger critics, the problem was a lack of personal responsibility rather than external economic factors.

“They Don’t Want to Face the Facts”

“It’s just this one segment of whiners on TikTok or something pops up because they don’t want to face the fact that they got to control the person in their mirror,” he continued.

All Part of the Plan?

His provocative advice and the ensuing backlash may be all part of the plan for Ramsey, who shares these radio and podcast clips on his official TikTok profile.

Gaining More Relevance

With a trending hashtag and high-profile news articles covering his tumultuous relationship with younger audiences, he has now gained more attention and relevancy with the 20-40-year-old Gen Z and Millennial demographic than he ever has before.

Ramsey Sticks to His Guns

Despite the pushback, Ramsey has stuck to his guns, urging Gen Z and Millenials to believe in their own financial agency. “I’ve been doing this for 35 years, and there’s always a group of people who say you can’t do it,” he said.

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

Featured Image Credit: Shutterstock / Serhii Krot.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply