A new report by housing experts has revealed some harsh home truths for many American families..

Housing Affordability

If you thought America’s real estate was pricey, you haven’t seen anything yet.

California’s Unaffordable Housing Crisis

According to a new study, four of the world’s top 11 most unaffordable housing markets are here in the U.S. – California, to be specific. The 2024 Demographia International Housing Affordability report has revealed how bad it’s gotten.

Cities on the “Impossibly Unaffordable” List

The prices in California are making the dream of homeownership nearly impossible for many. San Jose, Los Angeles, San Francisco, and San Diego have all made it to the “impossibly unaffordable” list.

San Jose: Leading the Affordability Crisis

San Jose is streets ahead, with a median house price that’s 11.9 times the median household income.

Los Angeles, San Francisco and San Diego

Los Angeles isn’t far behind at 10.9, with San Francisco and San Diego trailing at 9.7 and 9.5, respectively.

Affordability Challenges

In simpler terms, if your household brings in $100,000 a year, you’d need nearly $1.2 million to buy a home in San Jose – and over $900,000 in San Diego. Three decades ago, this kind of unaffordability was unheard of. So, what’s changed?

Causes of Unaffordable Housing

The people behind the report point the finger at strict land use policies. They argue that efforts to control urban sprawl – greenbelts, urban growth boundaries, and densification – are making land scarce.

Land Use Policies

Less land means higher prices, which trickles down to skyrocketing house prices.

Criticism of Urban Growth Boundaries

“The crisis stems principally from land use policies that artificially restrict housing supply,” the authors claim. Basically, government rules are making it harder for people to find affordable homes.

COVID-19’s Influence on Housing Costs

The COVID-19 pandemic didn’t help matters. Massive government spending, rock-bottom interest rates, and supply chain disruptions sent inflation soaring to a 40-year high of over 9% in 2022.

Federal Reserve’s Response to Inflation

To try and combat this the Federal Reserve jacked up interest rates to above 5%, which pushed mortgage rates from under 3% to around 7%.

Impact on Homeowners and Sellers

Homeowners who locked in those low rates are reluctant to sell and are holding onto their houses, which is causing a shortage of homes for sale and driving prices even higher.

Beyond California

California isn’t alone in this mess. The report also explores other North American cities facing serious affordability issues. Honolulu, Hawaii, for example, has a median price-to-income ratio of 10.5. Vancouver (12.3) and Toronto (9.3) in Canada aren’t doing much better.

Global Comparison of Housing Markets

These cities join the ranks of Australian and U.K. markets struggling with the same problem: homes are simply too expensive for the average earner.

Bright Spots In The Market

But it’s not all doom and gloom. The report does mention a few U.S. cities where housing is still somewhat affordable.

A Model of Affordability

Pittsburgh tops this list with a median price-to-income ratio of 3.1, followed closely by Rochester and St. Louis at 3.4 and Cleveland at 3.5. If you’ve been dreaming of owning a home, these might be the places for you.

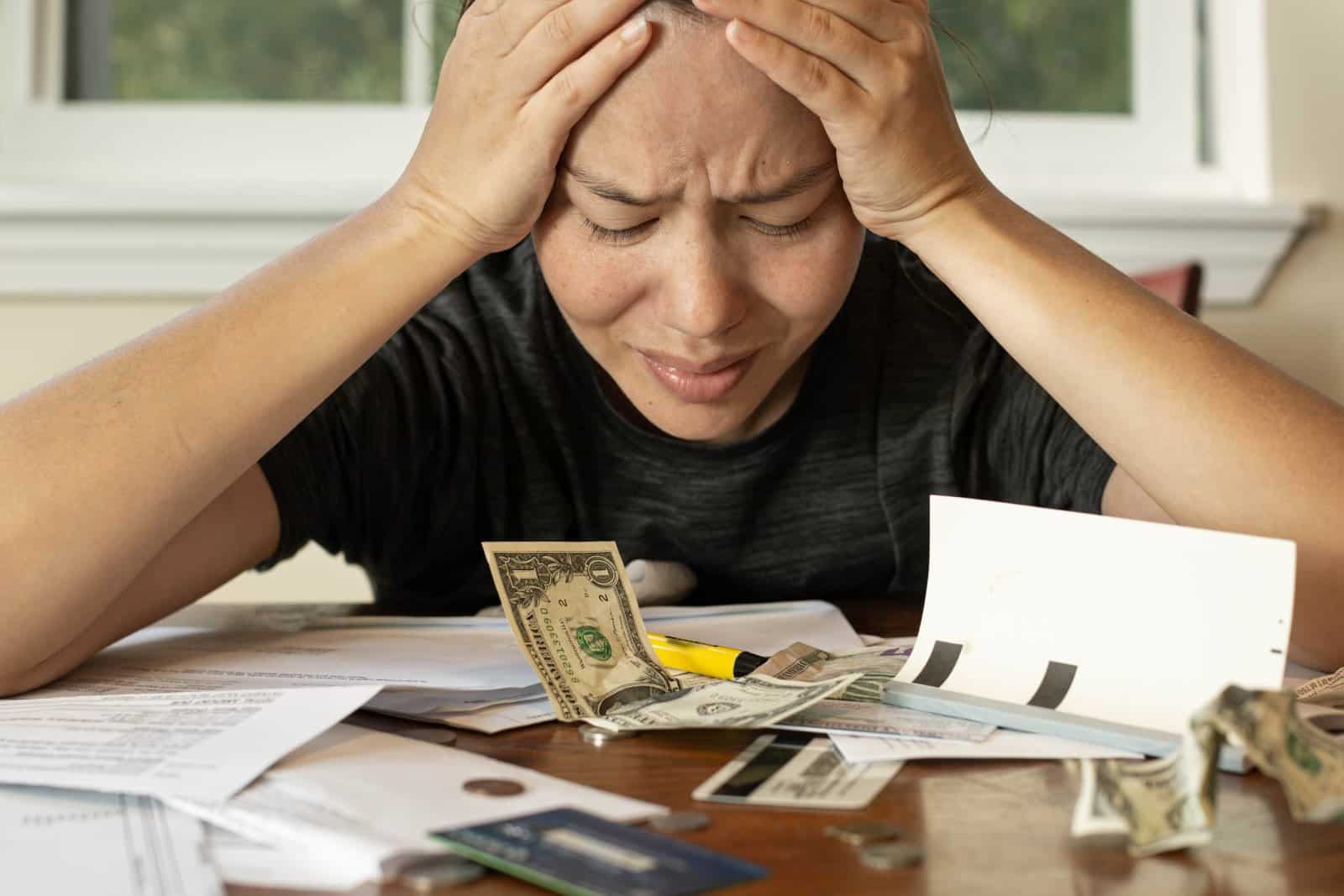

The Toll of Unaffordable Housing

The main issue with “impossibly unaffordable” cities is the massive toll it takes on people’s lives. Soaring home prices and rising living costs are squeezing household budgets.

Financial Strain on Households

Many families are now struggling with higher monthly payments for credit cards, car loans, and other debts because of those interest rate hikes. This financial pinch is making it even harder to save up for a home, pushing the idea of homeownership further out of reach for many.

Barriers to Homeownership

As the Demographia report lays it out, we’re in a housing affordability crisis, especially in California. Whether it’s restrictive land use policies, the pandemic’s economic fallout, or a mix of both, the result is clear: homeownership is becoming impossible for many.

Call for Creative Solutions in Policy Making

California’s housing market is a tough nut to crack. Policymakers need to get creative and find ways to increase housing supply and affordability before the dream of owning a home slips away for good.

Budget Boss: 12 Tips for Managing Your Money Wisely

Embarking on a journey to master budgeting requires evidence-based strategies supported by research to manage your finances effectively and achieve your financial goals. Here are 12 research-backed tips, along with actionable steps to implement them, for mastering budgeting and maximizing your financial well-being. Budget Boss: 12 Tips for Managing Your Money Wisely

Ranking the Top and Bottom 24 U.S. Universities

Wondering which universities are the cream of the crop and which ones fall short of the mark? Today, we’re ranking the 24 best and worst universities in the United States to give you the inside scoop on higher education excellence and disappointment. Are you ready to uncover the highs and lows of academia? Ranking the Top and Bottom 24 U.S. Universities

18 Trending Jobs That Let You Travel While Working

Dreaming of turning your wanderlust into a way of life? Believe it or not, there are careers that not only allow but encourage you to explore the globe, dive into new cultures, and collect experiences instead of things. Here are 18 unconventional jobs that offer just that, with a bit more insight into each. 18 Trending Jobs That Let You Travel While Working

The post Is California Destroying Your Housing Hopes? Find out Why Buying a Home There Is Now a Financial Nightmare first appeared on Not Your Boss Babe.

Featured Image Credit: Shutterstock / Stock-Asso.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

Leave a Reply